Organizing your finances doesn’t have to be complicated.

With a few straightforward steps, you can take control and avoid common money problems.

These 9 tips will help you build smarter financial habits starting today.

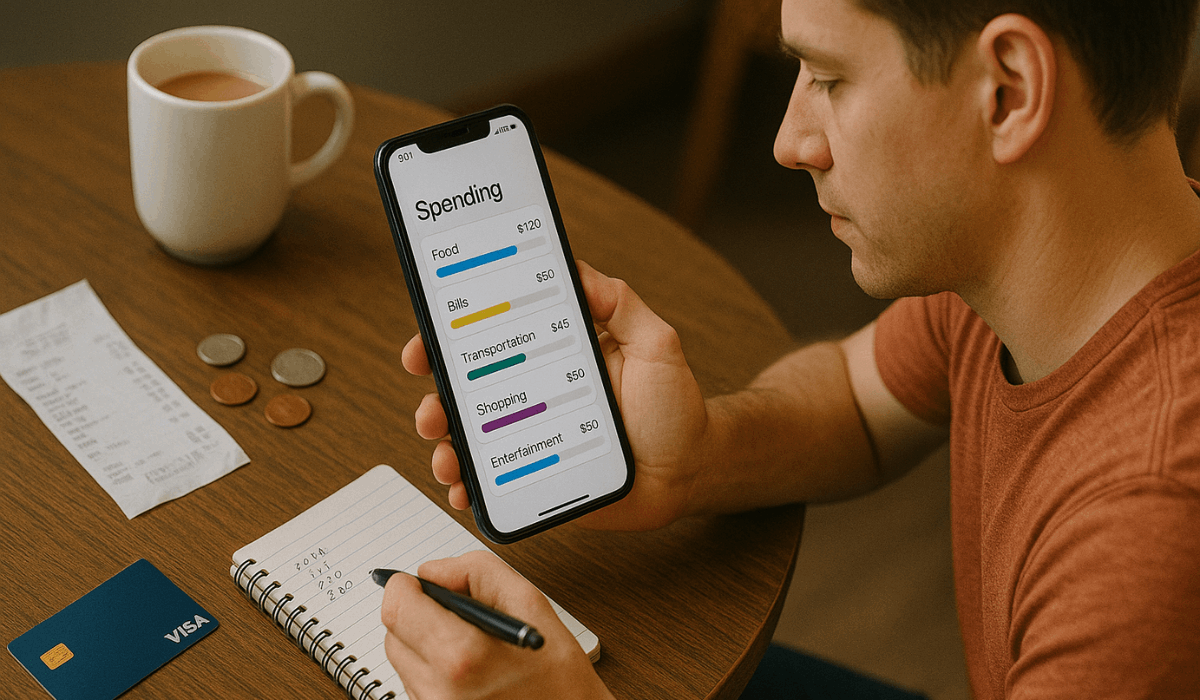

Track Your Spending Daily

Keeping track of your spending is the first step to financial control. It shows you exactly where your money goes and helps you make smarter choices.

- Record every expense. Use a notebook, spreadsheet, or budgeting app to track your daily spending.

- Be consistent. Make monitoring a habit by doing it at the same time each day.

- Group your expenses. Sort them into categories such as food, transportation, bills, and entertainment.

- Review weekly. Review your spending regularly to identify patterns and areas of overspending.

- Adjust as needed. Cut back where you overspend and shift funds to more critical areas.

- Stay honest. Don’t skip small purchases—they add up fast and affect your total budget.

Set Clear Monthly Budgets

A clear monthly budget gives you control over your money. It helps you plan, avoid overspending, and meet your financial goals.

- List your income. Start by noting your total monthly take-home pay.

- Break down fixed costs. Include rent, utilities, insurance, and other regular bills.

- Set limits for variable expenses. Allocate specific amounts for groceries, transport, and entertainment.

- Include savings goals. Treat savings like a fixed expense and pay yourself first.

- Track spending by category. Compare actual spending to your budget each week.

- Adjust monthly. Review and fine-tune your budget based on what worked and what didn’t.

Automate Your Payments

Automating your payments saves time and keeps your finances on track. It helps you avoid late fees, missed bills, and credit score issues.

- Set up auto-pay for bills. Use your bank or service provider to automate rent, utilities, and phone bills.

- Schedule payments after payday. Make sure funds are available when auto-pay runs.

- Automate credit card payments. Always cover at least the minimum to avoid penalties.

- Link savings transfers. Automatically move money to savings each month.

- Monitor your accounts. Verify that payments are processed correctly and balances are accurate.

- Review regularly. Update or cancel auto-pay setups if your income or expenses change.

Create an Emergency Fund

An emergency fund gives you a financial safety net. It protects you from unexpected costs, such as job loss, medical bills, or urgent repairs.

- Start small. Set your initial target at R$500 to R$1,000.

- Build up gradually. Set a goal of 3 to 6 months of essential expenses.

- Use a separate account. Keep it apart from your primary checking account to avoid spending it.

- Automate deposits. Schedule monthly transfers, even if they’re small.

- Avoid touching it. Use the fund only for real emergencies, not everyday expenses.

- Replenish when used. Rebuild the fund quickly after any withdrawal.

Review Your Subscriptions

Subscriptions can quietly drain your budget if you’re not careful.

Reviewing them regularly helps you cut waste and spend only on what you truly use.

- List all active subscriptions. Include streaming services, apps, memberships, and software.

- Check usage. Cancel anything you haven’t used in the last month or two.

- Watch for auto-renewals. Set reminders to cancel before free trials or billing cycles renew.

- Use tracking tools. Apps like Truebill or your bank’s spending insights can spot recurring charges.

- Consolidate where possible. Share family plans or switch to bundled services to save.

- Review quarterly. Make it a habit to review and audit subscriptions every three months.

Set Financial Goals

Clear financial goals give your money purpose. They help you stay focused, motivated, and organized as you plan for the future.

- Define short-term goals. These include saving for a trip, paying off a credit card, or building an emergency fund.

- Plan medium-term goals. Think about buying a car, starting a business, or funding education within the next few years.

- Think long-term. Retirement savings, buying a home, or investing for the future fall under this category.

- Make goals specific and realistic. Set clear amounts and deadlines to measure progress.

- Write them down. Keep them visible so you stay committed.

- Track progress monthly. Adjust your plan if your income or expenses change.

Use Separate Accounts

Using separate accounts helps you manage your money with more clarity. It reduces the chance of overspending and keeps your goals organized.

- Open a spending account. Use this for daily expenses such as food, transportation, and entertainment.

- Keep a bill account. Set aside money for rent, utilities, and subscriptions here.

- Create a savings account. Store your emergency fund and other savings in a separate place.

- Use alerts and labels. Set up notifications and rename accounts to match their purpose.

- Avoid mixing funds. Don’t pull from savings for non-essential expenses unless necessary.

- Review balances weekly. Ensure each account has sufficient resources to fulfill its role.

Check Your Credit Report

Checking your credit report helps you stay informed and protect your financial health.

It shows your credit history, score, and any errors that could hurt your record.

- Request a free report. Use services like Serasa, Boa Vista, or the official government site once a year.

- Review personal details. Ensure that your name, CPF, and contact information are accurate.

- Check open accounts. Look for any unfamiliar loans or credit cards.

- Spot late payments. Confirm that your payment history is accurate.

- Report any mistakes. Dispute errors with the reporting agency right away.

- Monitor your score. Use free apps to track changes and understand what affects it.

Plan for Retirement Early

Planning for retirement early gives you more time to grow your savings. Even small monthly contributions can make a big difference in the long run.

- Start as soon as possible. Don’t wait for the “right time”—start with what you can afford now.

- Use a dedicated retirement account. Consider private pension plans or investment funds specifically designed for retirement.

- Contribute regularly. Set up automatic monthly transfers to stay consistent.

- Take advantage of employer benefits. Join any available company pension or matching program.

- Review your plan yearly. Adjust your contributions as your income grows.

- Set a target amount. Know how much you’ll need to live comfortably and work toward that goal.

To Sum Up

Organizing your finances starts with simple, consistent actions that make a real difference over time.

These 9 practical tips help you take control, reduce stress, and build smart habits for long-term financial stability.

Start applying them today and take confident steps toward a stronger financial future.